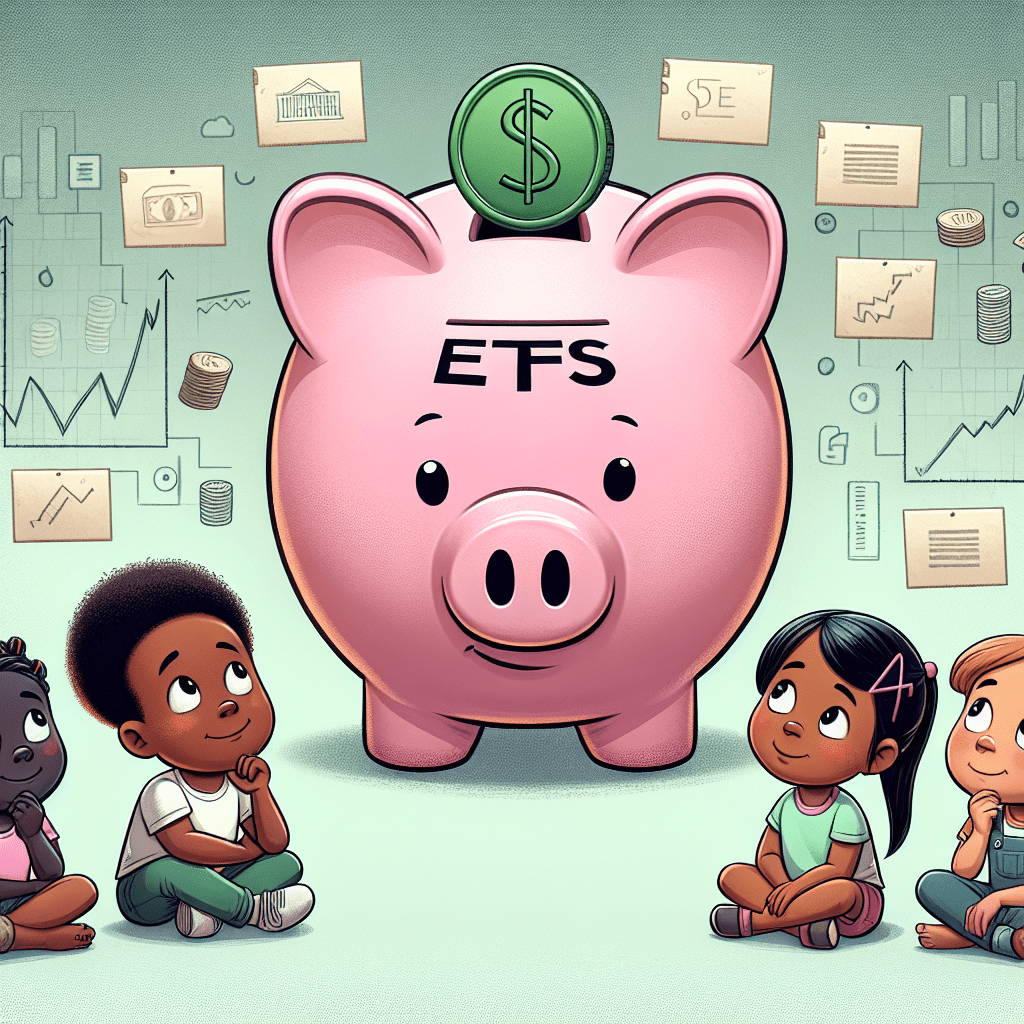

Investing for the Future: Why ETFs Are the Perfect Choice for Your Child’s Financial Journey

As a caring parent, you want to provide your children with every opportunity for success. One meaningful way to secure their financial future is through investing. Exchange-Traded Funds (ETFs) have emerged as a compelling option for parents looking to grow their savings for their children. ETFs offer a blend of flexibility, affordability, and ease of use that makes them an ideal choice in your family’s investment strategy.

Overview of ETFs

ETFs are funds that trade on stock exchanges, resembling individual stocks in how they are bought and sold. They pool money from numerous investors to purchase a diverse range of securities, such as stocks, bonds, or commodities. This diversification helps minimize risk while allowing for potential growth.

One of the standout features of ETFs is their liquidity. Investors can buy or sell shares throughout the trading day at real-time prices. This flexibility can be especially valuable for parents who may need quick access to funds for education or unforeseen expenses.

Another attractive aspect of ETFs is their cost-effectiveness. With lower fees compared to mutual funds, more of your investment capital goes towards achieving growth. Teachers, healthcare workers, and everyday families can readily find ETFs that align with their financial goals and values, making investing accessible for all.

Features of ETFs

- Diversification: ETFs hold multiple assets, lowering risk compared to investing in single stocks.

- Low Costs: Management fees are generally lower than those of traditional mutual funds.

- Transparency: Holdings are disclosed daily, providing clarity on investments.

- Tax Efficiency: ETFs typically incur fewer taxes due to their structure.

- Flexibility: They can be traded any time during market hours, unlike mutual funds.

- Dividends: Many ETFs pay dividends, which can be reinvested for greater growth.

- Accessibility: Investors can start with relatively small amounts of money.

- Global Reach: ETFs allow exposure to international markets without the hassle of foreign investments.

- Thematic Investing: Parents can choose ETFs that focus on specific themes, such as technology or renewable energy.

- Automatic Rebalancing: Many ETFs maintain their asset allocation, simplifying management.

Why Choose ETFs for Your Child’s Financial Journey?

Choosing ETFs is an act of empowerment for both you and your children. Investing in ETFs not only sets a foundation for financial literacy but also helps cultivate generational wealth. As your children grow, they’ll understand the importance of saving and investing, especially when they see the progression of their funds over time.

The educational aspect of investing with ETFs can spark interest in financial topics. As they learn, they will become more financially competent and confident in making their own investment decisions in the future.

Moreover, ETFs provide a disciplined approach to investing. Regular contributions to an ETF can foster good financial habits, teaching your children the value of steady growth and patience. This journey will equip them with tools to navigate their financial futures with ease and optimism.

Who Uses ETFs?

ETFs are utilized by a diverse group of investors, including:

- Parents: Many parents invest in ETFs for their children’s education or future expenses.

- Young Adults: College students often invest small amounts to start building wealth.

- Retirees: Older generations use ETFs for income generation and capital preservation.

- Financial Advisors: Professionals recommend ETFs as part of a diversified portfolio.

- Institutions: Universities and large foundations use ETFs to manage endowments and funds.

When and How to Use ETFs?

Consider the timeline and goals when investing in ETFs. If your child is still young, a long-term investment approach may be best, allowing for a buy-and-hold strategy. Regular contributions, even small ones, can lead to substantial growth over time.

To start investing in ETFs, consider these steps:

- Open a Brokerage Account: Choose a platform that supports ETF investments and has low fees.

- Research ETFs: Look for funds that align with your values and financial goals.

- Set a Budget: Decide how much to invest initially and how much to add regularly.

- Diversify: Consider investing in multiple ETFs for broader coverage.

- Monitor Performance: Review holdings periodically to ensure they meet your expectations.

Pros and Cons of ETFs

Every investment option has strengths and weaknesses.

Pros:

- Diversification reduces risk.

- Low costs enhance overall returns.

- Real-time trading offers liquidity and flexibility.

Cons:

- Some ETFs may be subject to high volatility.

- Trading fees can add up if frequently bought and sold.

- Limited management can lead to missed opportunities for astute investors.

Similar Investment Products

While ETFs are an excellent choice, other investment vehicles may be worth exploring:

- Mutual Funds: Professionally managed, offering diversification, but usually come with higher fees.

- Stocks: Individual shares can yield high returns but carry greater risk.

- Bonds: Less volatile, providing fixed returns with down-to-earth safety.

- Index Funds: Similar to ETFs, offering market tracking at low costs.

- Robo-Advisors: Automated management providing diversified portfolios based on your risk preference.

FAQs about ETFs for Kids

-

What is an ETF?

An ETF is a fund that trades on stock exchanges, comprising various assets for diversification. -

How can I open an ETF account for my child?

You can set up a custodial account with a brokerage to manage the investments until your child reaches adulthood. -

What age should I start investing in ETFs for my child?

Starting as early as possible is preferable; the earlier you begin, the more time your investment has to grow. -

Are there ETFs specifically for education savings?

Yes, some ETFs focus on education or long-term savings, making them suitable for parents. -

Can I withdraw money from my child’s ETF account?

Withdrawal policies depend on the account type; custodial accounts may have restrictions until your child is of age.

Instantly Access Your FREE Children’s Books Here!

Disclaimer: As an Amazon Associate, I earn from qualifying purchases. I may earn a commission from qualifying purchases as an affiliate. Please note that I only recommend products I believe will provide value to my readers.